Business owners commonly interact with multiple types of employees over the lifespan of their company. Both traditional employees and independent contractors are fairly straightforward to work with, but what happens when you start mixing the two? A statutory employee is a hybrid between both, and a worker must meet specific criteria in order to become one.

So what is a statutory employee? Below we’ll discuss the definition, criteria, and tax implications of having a statutory employee on your payroll.

A statutory employee is an independent contractor that a company treats as a salaried employee for tax purposes. Because Medicare and Social Security are the only taxes employers are required to withold from their earnings, statutory employees are able to write off employment expenses. Contrary to traditional employees, employers are not required to offer statutory employees benefits or cover the costs of tools needed to perform their work.

The employer of a statutory employee will pay their portion of taxes, 7.65%, which is half of the total FICA taxes of 15.3%. We’ll go into more detail about this in the sections below. FICA taxes are a combination of Social Security and Medicare taxes that both the employee and employer contribute to.

The Internal revenue service has specific criteria that qualify somebody as a statutory employee. Here are the exact specifications from the IRS statutory employee website page:

As we briefly touched on before, statutory employees have the same benefit as traditional employees, the tax break. The Federal Insurance Contribution Act , also known as FICA taxes, is made up of two contribution types:

This makes total FICA taxes 15.3%. If you are an independent contractor, you are responsible for paying the entire 15.3% come tax time. Statutory employees and regular employees are only responsible for half (6.2%), with the other half covered by the corporation they work for.

Statutory employees are seen as beneficiaries of extra perks that independent contractors don’t normally see. However, there are still some cons to being classified as a statutory employee.

Statutory employees have two advantages over traditional employees that are guaranteed by law. Any other perks provided are based on their employer’s company policy. Here are the pros:

Although they hold the title of “employee,” statutory employees are still bound by independent contractor restrictions in some aspects. Here are the cons:

Not eligible for benefits: As with an independent contractor, statutory employees are omitted from receiving traditional employee benefits. These include 401(k) contributions, paid time off, and health insurance.

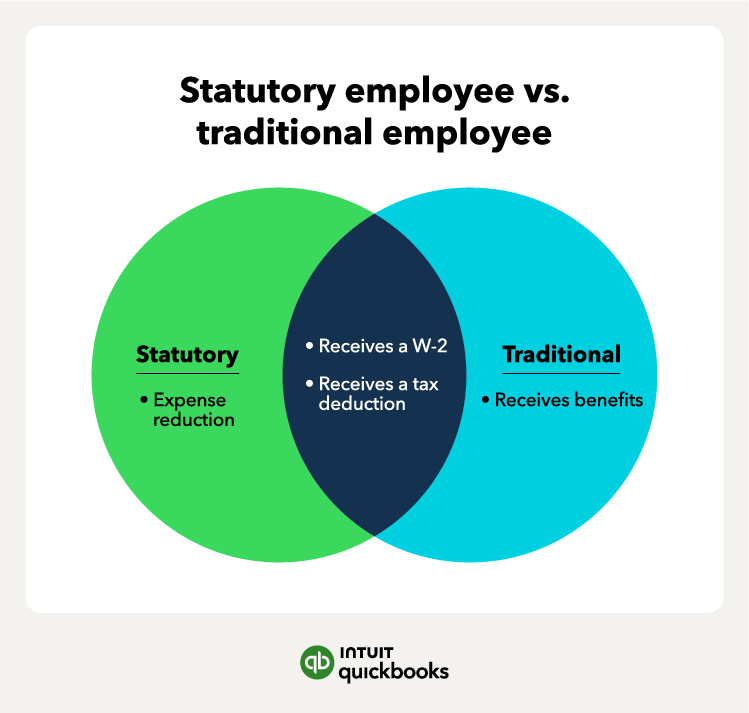

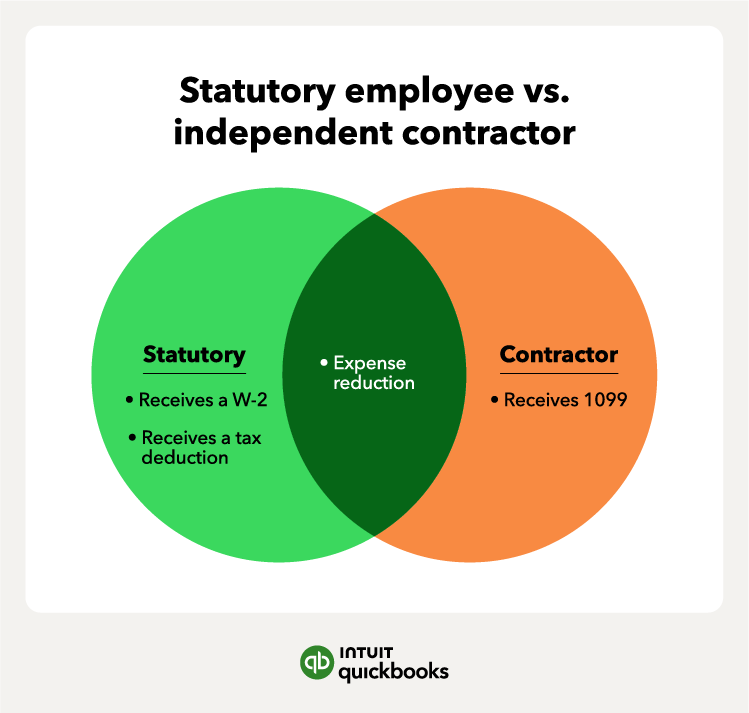

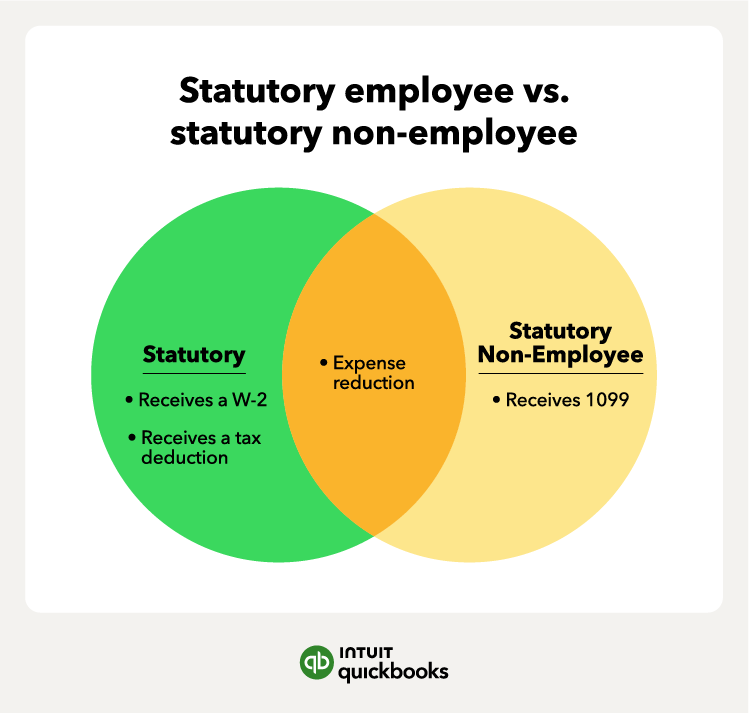

To break down the differences even further, let’s look at three classifications and compare the similarities and differences between them. We’ll look at the statutory employee compared to a traditional employee, then an independent contractor, and finally a statutory non-employee.

Statutory employees and traditional employees are the same in that they both receive W-2s and receive a tax deduction on FICA taxes. However, traditional employees qualify for benefits such as health insurance, while statutory employees don’t. To offset these benefits, statutory employees can write off some of their business-related expenses while traditional employees can’t.

Statutory employees and independent contractors are the same in that they both receive business-related expense reductions. This means that they can write off a percentage of their business expenses.

These business expenses include mileage, a home office, cell phone, and vehicle expenses, to name a few. However, statutory employees receive a W-2 as well as a 50% tax reduction in FICA taxes. Independent contractors are responsible for the full 15.3% FICA and will receive a 1099 at the beginning of the year.

Statutory employees and statutory non-employees work a bit differently. A statutory non-employee is categorized as an independent contractor. You’ll notice in the diagram below that their similarities and differences match the independent contractor comparison exactly. The criteria to qualify as a statutory non-employee is what should be focused on. This includes:

Once you understand the foundational differences between statutory and non-statutory employees, you’ll see that there isn’t much to worry about in terms of hiring and payment.

However, if you’re feeling confused about the taxes and accounting portion of the process, a tax expert may be able to help. For your next steps, make sure you’re using proper bookkeeping techniques to keep your books current for the end-of-year tax time.

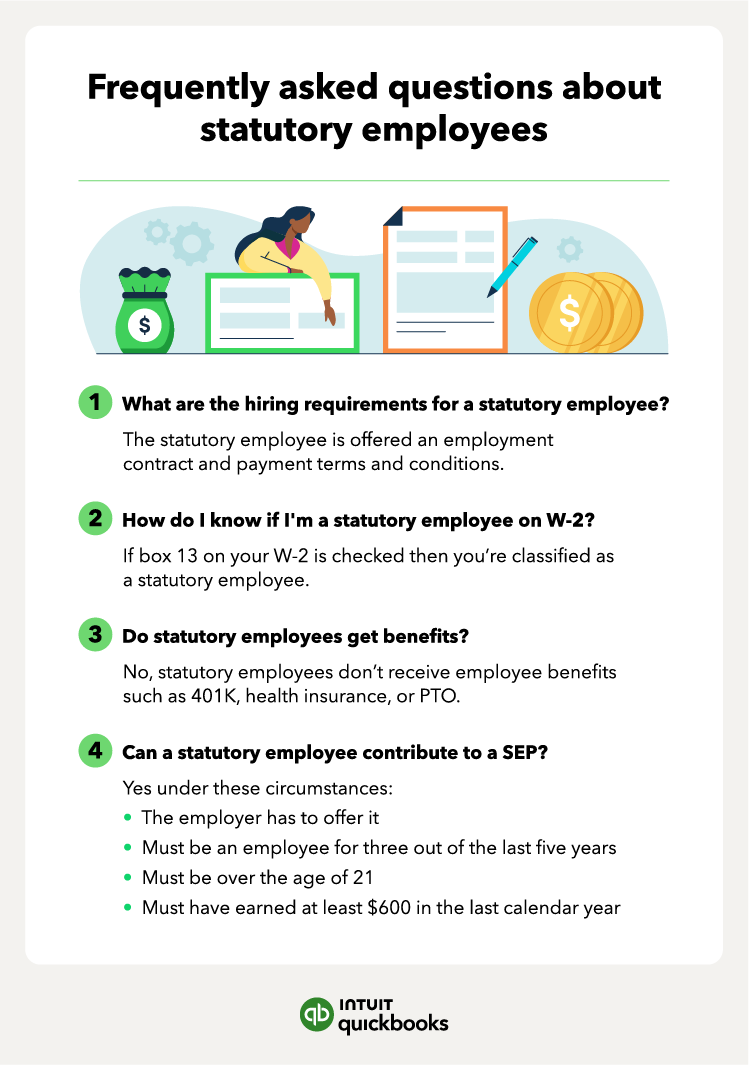

Hiring requirements for a statutory employee are the same as the hiring requirements for a standard employee. The statutory employee gets an employment contract as well as payment terms and conditions.

The employer then collects a W-9 from the statutory employee that verifies their name, address, and tax identification number.

How do I know if I'm a statutory employee on my W-2?Once you receive your W-2, it will look nearly identical in format to that of a standard employee. The indicator of a statutory employee is a small box checked near the bottom labeled “box 13.”

Do statutory employees get benefits?Statutory employees enjoy the benefits of receiving partial tax credits as well as the ability to write off portions of their business-related expenses. Statutory employees, however, do not receive full employment benefits such as health insurance, 401(k) contributions, and paid time off (PTO).

Can a statutory employee contribute to a SEP?A simplified employee pension (SEP) is an individual retirement account separate from a 401(k). Here are the criteria f or contributing if you are a statutory employee:

Small business employee benefits guide for 2024

October 17, 2023

1099 vs W-2: What’s the difference?

September 9, 2022

What is a 1099? Types, details, and how to pay contractors

October 30, 2023

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.